How Do Pensions Work (And Why Do They Matter)?

Pensions are one of the best benefits offered by trade unions. They’re one of the reasons union members get to enjoy a good deal of financial security, even after they retire.

Like other financial concepts, pensions aren’t always easy to understand. They involve a number of jargon and technical terms, and it’s easy to become overwhelmed by them.

In this article, we’ll go over some of the basics in plain English. By the time you get to the last paragraph, you should know how pensions work and why getting one is a great advantage.

Benefits of a Union-Backed Pension

In a nutshell, a pension is a retirement plan that sets aside a certain amount of money over the duration of your employment. The goal is to accumulate enough funds so that you can draw on them after you retire.

Employers are not obligated to provide their workers with a pension plan. In many cases, employees who want to save for retirement have to do it on their own by putting a portion of their income into an investment account.

That’s not the case for workers who are part of a trade union. Nearly every single trade union will negotiate contracts on your behalf to ensure that your employer puts money into a pension (or two) on your behalf.

Not only does this guarantee that your pension will grow steadily, it also does so at the employer’s expense instead of yours.

Pensions secured through the union are also part of multi-employer pension plans. In other words, your pension stays with you and continues to grow no matter what union signatory contractor you work for, or how many times you change contractors.

The Three Most Common Types of Pensions

Many locals offer multiple types of pensions, as well as 401k retirement accounts. We’ll cover the three most common ones you’ll encounter as a union tradesperson.

Defined Benefit Pensions

Defined benefit pensions are the most common type. Nearly every single union will offer one.

As the name implies, these pensions will give you a set monthly benefit for the rest of your life once you retire. The employer pays into a single pension fund that all union members then draw from.

These funds grow tax-free, but every plan calculates the payout differently and sets its own parameters for when you can start drawing from the pension. One local might let you retire after 20 years of service, no matter how old you happen to be at that time. Others won’t pay out until you reach 60 or 65 years of age.

Typically, if the pension is well-funded and well-managed, the union local will have looser rules about retiring early. Otherwise, there are stricter requirements to ensure the account doesn’t get drained by too many workers cashing out early.

Contribution Pensions / Annuities

Where a defined contribution plan has employers paying into a single shared account, a contribution pension means the employer will fund a separate annuity account for each employee.

This can provide you with a bit more flexibility. Depending on the rules of your particular plan, you might be able to withdraw your retirement funds as a lump sum rather than take a monthly payout.

Since each employee has their own account, the amount in the fund will depend on individual factors like how many hours or years you worked, how much your employer put in, and how well the investments did.

401k

The majority of locals offer a 401k, but only a handful of them have employer funded 401k plans.

A standard 401k is an employer-sponsored individual retirement account that allows you to invest a portion of your pre-tax income into the stock market.

If your employer funds the 401k on your behalf, you can still elect to deposit money into the account. This is an excellent way to ensure a secure future, since both you and your employer can work together to provide you with a very generous retirement.

Why You Should Contribute to Your 401k

If you have an employer-funded plan, it’s tempting to let them take care of it without setting anything aside yourself.

After all, why should you contribute to your 401k if you’re getting a pension?

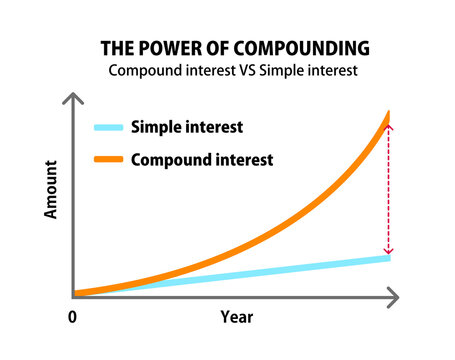

The answer to that is simple: compound interest.

Compound interest is what you get when you buy into an investment (like buying stocks) and then re-invest all the earnings. Instead of growing slowly, your initial investment snowballs. Your money essentially makes money.

What does that look like in practice? Well, let’s suppose you’re an ironworker who makes $30 an hour. You elect to invest 10% of that income in a 401k plan that tracks the S&P 500 (which has a 50 year historical return of 10%). Even if you don’t get a single raise, over the course of 30 years that diligent but relatively small investment in your 401k will balloon to a million dollars by the time you retire. Even better, if you start investing that much when you’re 25, you can expect to have just under three million by the time you retire at 65. Add in your yearly contractual raises however, and these numbers can snowball even bigger.

It’s by far the easiest way to become a millionaire, and it’s accessible to most trade union members.

Now, combine that 401k with another pension (or two!) and you’ll be looking forward to a luxurious retirement. And all it takes is that modest 10% contribution on your part.

Pay Attention to the Details

Knowing the types of pensions that might be available to you will make it easier to decide which one is the right choice for you.

It’s important to pay attention to the details, however. We’re talking about your retirement here, so you want to make sure you know exactly what you’re getting into.

For instance, some pensions will come with a cost of living escalator, meaning your benefit will increase each year to match the rate of inflation. If your pension doesn’t include this, you’ll need to plan ahead so you don’t end up with a payout that won’t meet your needs.

You also want to avoid doing anything that jeopardizes your funds. In my local, for example, you must not only work for 20 years before cashing out, you also have to be considered in “good standing” to qualify for your pension. That’s not hard to achieve, but it’s definitely something you’ll want to know.

Ask your local if they have a class on the pension funds they offer. If not, you should still be able to schedule a meeting with someone from the trust office to go over the details and get answers to all your questions.

Having a pension is a great benefit, but how great it is will depend on the details. So take the time to go over them, make sure you understand exactly what you’re getting, and find one that will set you up for the future you want instead of the one you settle for.